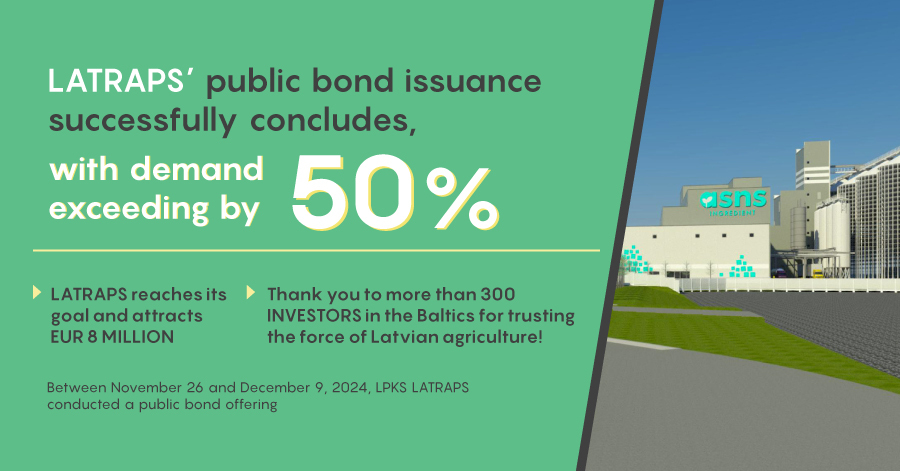

LATRAPS' first public bond issuance successfully concludes, with demand exceeding by 50%

One of the largest grain exporters in the Baltics, LATRAPS has successfully raised €8 million during its public bond offering with a fixed interest rate of 7.5%. The total demand for the bonds exceeded initial expectations, reaching more than €12 million, surpassing the initial bond offering target by 50%.

Interest from both retail and institutional investors has been strong since the publication of the Information Document, emphasizing the strength of the agricultural sector and the potential of the ASNS Ingredient project in the Baltics. Over 300 private and institutional investors took part in the public bond offering. In terms of investment volume, Latvian investors made up to 90% of the total demand.

Roberts Strīpnieks, Chairman of the Board at LATRAPS, commented: “The results of our first public bond offering reflect the community's interest in participating in the development of the agricultural sector and in strengthening Latvia's name on the global economic map, for which I am grateful to every investor. From today, not only the 1220 members of LATRAPS are involved in this important process, but also more than 300 investors. I am pleased that the goal of this issuance is ambitious and tangible for all of us together – to build the largest pea protein isolate factory in Northern Europe, ASNS Ingredient, where construction is planned to start this month.”

“LATRAPS example illustrates that an issuer with a good reputation, solid financial performance and well-developed growth plans is not only able to attract significant interest from institutional investors, but also motivates an increasing number of Latvian private investors to start their investment journey in bonds. We are happy to see substantial interest from Latvian investors, as every LATRAPS bond investor will help the issuer implement one of the largest investment projects in Latvia in recent years,” assessed Kristiāna Janvare, Head of Investment Banking at AS Signet Bank.

Estonia’s largest farmers association, KEVILI, also expressed its views on the LATRAPS bond offering: “We are proud of our Latvian colleagues and fully support them in this public bond offering. We see it as setting a bold example for other farming associations in the Baltics, including KEVILI. Agriculture, especially the cultivation of grains and rapeseed, is an area where we have much in common to strengthen our cooperation. Estonian farmers will take the opportunity to supply peas to the new ASNS Ingredient facility, thereby fostering the growth of agricultural exports from our region and enhancing the global recognition of the whole Baltic agricultural sector.”

As demand for the bonds significantly exceeded the issuance volume, the allocation to investors is made according to the principle of proportionality, aiming to establish a stable, diversified, and reliable investor base.

Following the bond issuance, LATRAPS will submit an application to Nasdaq Riga for the listing of the bonds in the Nasdaq Baltic First North alternative market.

The bonds will be settled on December 12, 2024. Bondholders will receive quarterly coupon (interest) payments, with the first coupon payment being made on 31 March, 2025.

The arranger of the bond issue is AS Signet Bank, while legal advice is provided by the law firm TGS Baltic.